Please note that the Terms of Use was last revised on February 5, 2025

This is the link that the Merchant creates and sends or presents to the Client for the payment of a Good and/or Service.

The link can be a clickable URL or a QR Code that the Client must scan to make the payment via the Slick-PAY mobile application, or alternatively via any QR Code reading application.

NB: At the time of payment, the customer will be redirected to the SATIM platform via the Slick-PAY plugin, meaning that the card data and banking details of Merchants and Clients are stored and held by SATIM.

Thanks to the Slick-PAY service, any merchant with a commercial register and a business bank account, and having requested authorization to benefit from the online payment service from SATIM and GIE Monétique, can benefit from online payments, either by integrating the API for Web-Merchants, or by using the Slick-PAY invoicing service for merchants who do not have an online sales platform.

The e-consumer refers to any natural or legal person who has entered into a cardholder contract with a bank or post office issuing CIB or EDAHABIA payment cards, resulting in the issuance of a CIB or EDAHABIA payment and withdrawal card. In the context of online payment, the cardholder is a buyer who uses their CIB or EDAHABIA card to make payments for goods or services on the internet.

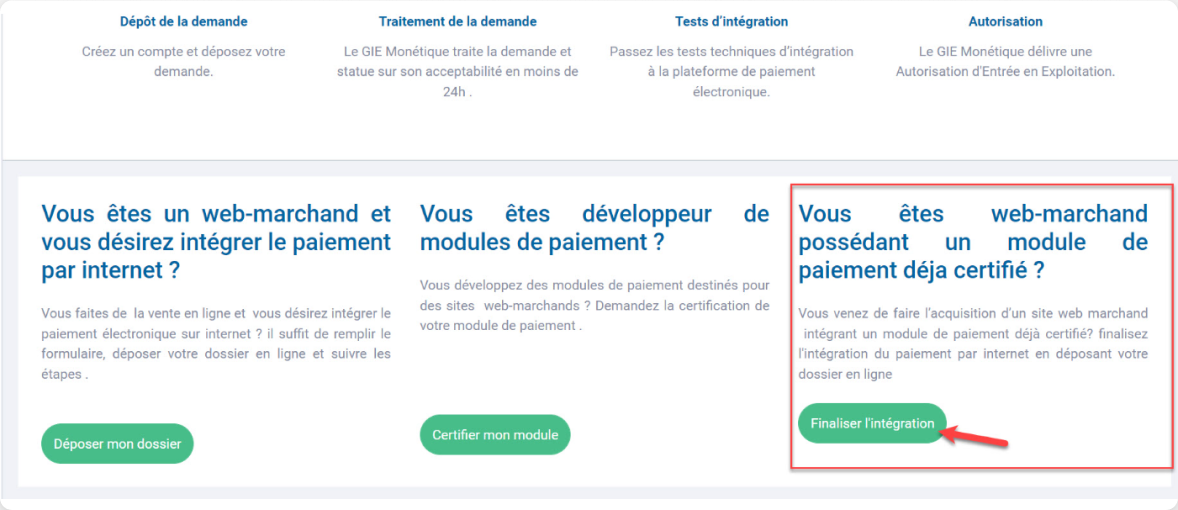

Then finalize the integration as the Third profile by clicking on the button to finalize registration, as shown in the following figure:

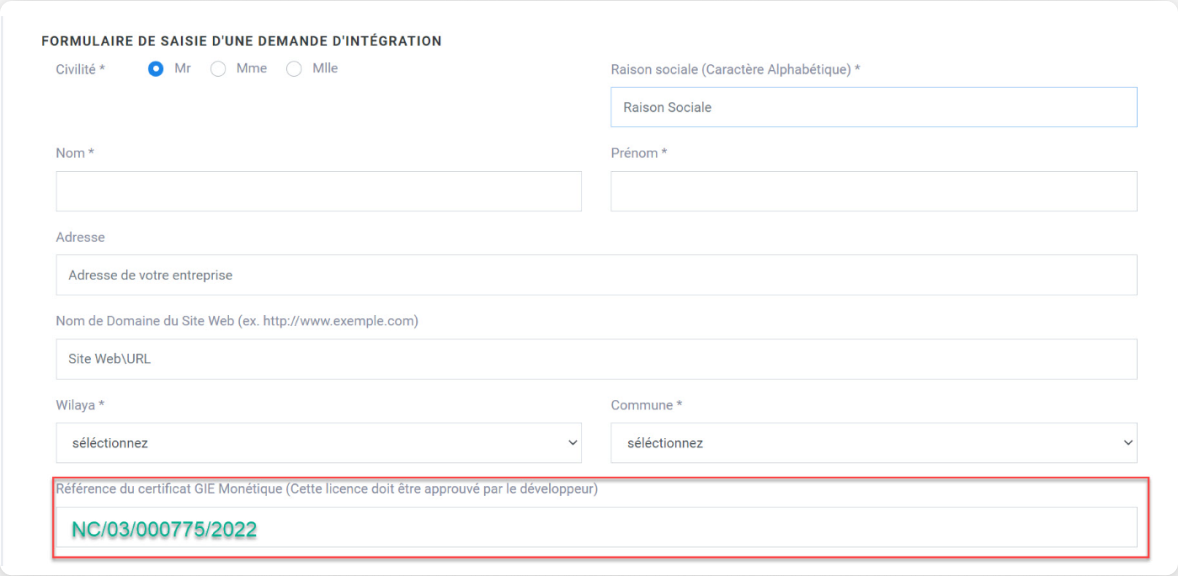

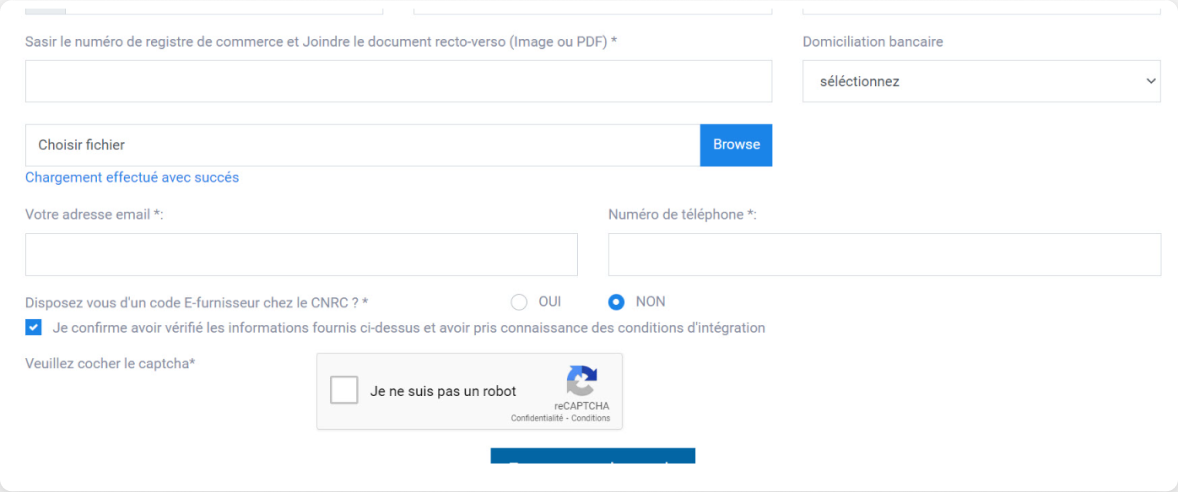

A form is presented to fill in the information about the company (Merchant), using the same data provided to the bank.

In the field ‘Reference du certificat GIE Monétique’ enter the certificate number as follows: NC/03/000775/2022.

At the end of this operation, Slick-PAY will receive a notification to approve your request. Once approved, GIE Monétique takes over and validates the merchant account, and issues an Authorization. This will be transmitted to the Merchant and to the bank.

The merchant will then be contacted by their bank for the signing of the agreement, for production entry, and will receive the access to connect to the Slick-PAY API.

You are responsible for the content and information you share during payments. You agree not to use our payment gateway for illegal, fraudulent, or unethical purposes.

The use of our payment gateway is subject to transaction fees, which are clearly indicated during the payment confirmation. You agree to pay all fees associated with the use of our service in accordance with our pricing grid.

We are committed to ensuring the security of your payment data and complying with the current security standards. You agree not to attempt to bypass or compromise the security measures of our system.

You are required to comply with the regulations and laws applicable to financial transactions and data protection. You also agree not to use our service for fraudulent purposes or to facilitate illegal activities.

Users of the mobile application who have saved their card data are required to secure and not disclose the smartphone unlock codes.

As for the security of card data, this part has been subject to a compliance certification from a laboratory accredited by the GIE (Compliance Certificate; PCI Mobile Acceptance Security) PCI-DSS Compliant.

The Internal Merchant is obliged to use exclusively the business account for transactions carried out on Slick-PAY; the use of a personal account is considered an offense and is strictly prohibited.

Fundraising operations are strictly prohibited except for associations holding the Fundraising Authorization issued by competent authorities.

All content presented on our payment gateway, including logos, trademarks, and information, is protected by intellectual property laws. You may not copy, reproduce, or use this content without our express permission.

We understand the importance of your satisfaction using our payment gateway. Our refund policy aims to provide you with a fair and transparent customer experience. Please read the following conditions regarding refunds carefully:

You can request a refund if you have made a transaction in error or if a payment has been processed incorrectly.

Refund requests must be submitted within [insert the timeframe here] days from the date of the initial transaction.

The refund request is made by the interested party on the Web or Mobile application; this is received directly by the Merchant, who can either accept or reject it with a reason.

In case of disagreement, please contact us by email at [email protected], providing details of the transaction and the reason for your request.

We will review each refund request on a case-by-case basis, and we reserve the right to reject requests that do not meet our eligibility criteria.

Depending on the nature of the refund request and the circumstances of the transaction, we may offer a partial or full refund of the initial amount paid.

Processing or service fees may be deducted from the refunded amount.

We strive to process refund requests within a reasonable time. The exact processing time may vary depending on the case.

Certain specific products or services may not be eligible for a refund. In such cases, the merchant must indicate this on the note accompanying the payment link.

We reserve the right to modify our refund policy at any time without notice. Any changes will be published on our website.

If you believe that an unauthorized transaction has been made through our payment gateway, please contact us immediately so that we can investigate and take appropriate measures.

In case of a dispute regarding a refund, we will do our best to resolve the issue amicably and fairly. If no agreement is possible, disputes will be subject to the laws and regulations in force in the relevant jurisdiction.

Last revised on February 5, 2025